Multi-Peril Crop Insurance (MPCI)

Approved Insurance Providers (AIPs) administers the Federal Crop Insurance Program such as our partners Diversified Crop Insurance Services (DCIS) and Rain and Hail. Private insurance companies that are reinsured by FCIC have sold and serviced all Multiple Peril Crop Insurance products approved by the Federal Crop Insurance Act since 1998.

Staying current in the insurance industry is often a challenge. Program guidelines constantly change for added crops and plans. No other agents are more dedicated to keeping up with these changes or have more dependable expertise than ours. We are knowledgeable of available policies in your area that meet your risk management needs and work best for your operation whether you are a conventional or organic producer.

MPCI policies continue to become available in new counties, implement pilot programs and add offerings for conventional and organic farming operations. A few areas of our expertise include:

- Whole Farm Revenue Protection for a diverse farming operations that include conventional and organic commodities as well as livestock

- Annual Forage

- Forage, Pasture and Rangeland

- Tree Protection and Pecan Revenue Protection

- Conventional farming irrigated and dryland practices (grain sorghum, sesame, cotton, canola, soybeans, peanuts, wheat, and oats)

- Organic farming dryland and irrigation practices

- TYPES OF POLICIES:

- RP – Revenue Protection (Guarantees yield x price)

- YP – Yield Protection (Guarantees yield)

- COVERAGE LEVELS:

- CAT (catastrophic / yield protection only / 50% coverage – 55% of market price)

- 50-85% coverage levels options on most crops

- UNIT STRUCTURE:

- Enterprise

- Basic

- Optional

Pasture, Rangeland, and Forage

This risk management tool insures against widespread loss of production of the insured crop in a designated area called a grid. Coverage is based on the experience of a grid rather than individual farms.

Coverage under the Pasture, Rangeland, Forage (PRF) program is available for two crop types: Grazing and Haying. Losses are paid when the grid’s accumulated index, known as the final grid index, falls below the insured’s trigger grid index. Lack of precipitation is the only cause of loss covered by Rainfall Index (RI).

How It Works

PRF-RI was designed to help provide protection from increased feed costs due to forage losses. Unlike other MPCI programs, not all acres of forage are required to be insured. The policyholder can select only those acres that are most important to the haying or grazing operation. The coverage is a selected dollar amount of protection per acre.

For example:

Example: County base value = $39.00

You elected a coverage level = 90% and a Productivity Factor = 120%

$39.00 × 0.90 × 1.20 = $42.12 is the dollar amount of protection per acre.

The dollar amount of protection per acre will apply to all insured acres by crop type for the county.

Whole Farm Revenue Protection

Whole-Farm Revenue Protection (WFRP) provides a risk management safety net for all commodities on the farm under one insurance policy. This insurance plan is tailored for any farm with up to $8.5 million in insured revenue, including farms with specialty or organic commodities (both crops and livestock), or those marketing to local, regional, specialty or direct markets.

WFRP protects your farm against the loss of farm revenue that you expect to earn or will get from:

- Commodities you produce during the insurance period, whether they are sold or not;

- Commodities you buy for resale during the insurance period; and

- All commodities on the farm except timber, forest and forest products; and animals for sport or pets.

The policy also provides replant coverage:

- For annual crops, except those covered by another policy;

- Equal to the cost of replanting up to a maximum of 20 percent of the expected revenue; and

- When the lessor of 20 percent or 20 acres of the crop needs to be replanted.

The approved revenue amount is determined on your Farm Operation Report and is the lower of the expected revenue for the insurance year or your whole-farm historic average revenue. If established criteria is met, historic revenue may be eligible for indexing or expanding operations calculations which would increase the revenue covered by WFRP.

Causes of Loss WFRP provides protection against the loss of insured revenue due to an unavoidable natural cause of loss, that occurs during the insurance period and will also provide carryover loss coverage if you are insured the following year.

Losses Under Whole-Farm Revenue Protection Claims are settled after taxes are filed for the insurance year. A loss under the WFRP policy occurs when the WFRP revenue-to-count for the insured year falls below the WFRP insured revenue.

Crop Hail

It costs a bundle of money to produce a crop. Machinery, seed, fertilizer and chemical costs continue to increase, which means the producer has a lot at stake. Crop Production is risky. Do not let a hailstorm cause financial stress.

When a producer plants without protection, he/she is risking years of potential profits. Producers can have all the right timing and inputs, but without the right coverage, they are still at risk.

Risk Management Crop-Hail coverage (up to the full value) can be the basis for the late season pre-harvest crop sales to maximize profits at a reduced risk. Protection can be increased as bumper crop yields or higher prices become apparent.

Crop-Hail coverage also covers the deductible portion of MPCI protection. MPCI and Crop-Hail coverages may both be eligible for payment on the same loss event.

Benefits of Crop-Hail Coverage

- Protects profits

- Fosters greater grower confidence to do pre-harvest crop sales

- Protects crops up to the full value

- Acre-by-acre coverage provides protection from isolated damage

- May be used as loan collateral

- Rewards the more businesslike grower

- Discover how crop insurance can provide worry-free protection for the tough times

Livestock Risk Protection

Livestock Risk Protection (LRP) provides protection against declining livestock prices if the price, as specified in the policy, drops below the producer’s selected coverage price.

Benefits of LRP:

- Guaranteed price – no bid/ask spread

- Limited basis risk coverage – the aggregate cash price used better reflects actual price received

- Any number of head can be covered (up to limits)

- Numerous endorsement period options – producer selects the period that fits his/her risk management plan

- Wider range of target weights than CME

- LRP is an insurance policy – may be viewed more favorably by lenders than hedging or speculating

How it works for Cattle:

Pasture Cattle Herds

Through our sister location, SouthWest Ag Services, we are able to offer our customers pasture cattle insurance to protect your entire herd. This policy provides coverage for losses caused by death or humane destruction of livestock as a result of a specified peril. Coverage is for both owned livestock and non-owned livestock in your care, custody and control. Causes of Loss includes:

- Fire, lightning, explosion, or smoke

- Windstorm, hail or tornado

- Smothering by blizzard or snowstorm

- Collision with vehicles, aircraft or falling objects

- Earthquake

- Flood, drowning, mudslide

- Accidental shooting

- Electrocution

- Attack by dogs or wild animals

- Collapse of buildings, barns, bridges or culverts

- Sinkhole collapse

- Hypothermia due to precipitation

- Leakage of gas or anhydrous ammonia

- Contaminated feed or water

Deductible options: $500 or $1,000

Limits up to $10,000,000 per occurrence

Additional Endorsements to Add-On:

- Livestock Born during the Policy Period – to cover any calves born during the policy period for fair market value and at any of your pasture locations.

Example Scenario and Pricing Structure:

- 1,000 head of black and mixed cows (80% black, 10% red angus, 10% black baldy cows)

- Avg. weight 1100-1500

- Average Value = $1,500, max value = $2,000

- Total Value = $1,500,000

- Add Livestock Born Endorsement

Premium Cost = $7,188.00 or $7.18/head

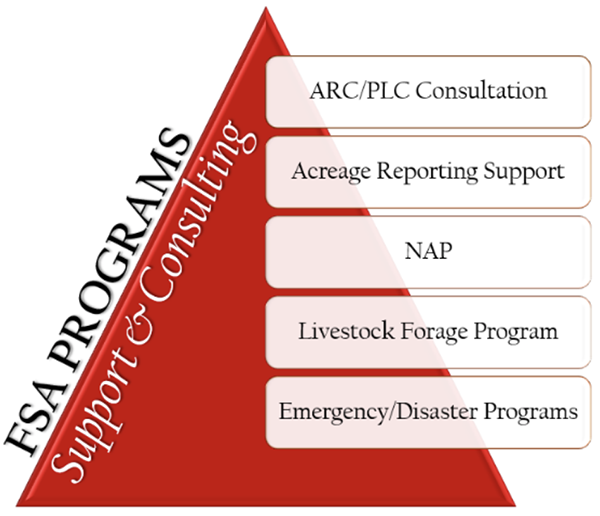

FSA Programs Support & Consulting

Designed as an annual subscription-based service to provide you support and consultation. Provides the security of knowing you will be informed and up to date on all FSA Programs as they arise. This service is led by Quinn Spraggins, who has more than six years of experience working for Tillman County FSA. She has a proven track record with producers in providing them excellent service and advice to help make FSA program decisions.

Our commitment to service made this decision easy to add a new offering. FSA Programs support and consulting offers a total producer care model designed to improve your efficiency and farm operation decisions. We feel it fits perfectly under the SouthWest Ag umbrella while maintaining a segregation of duties and the utmost in confidentiality. We have confidence in Quinn’s expertise and know she will maintain the same level of service that is our brand and that the SouthWest Ag customers expect.

Services Offered

- ARC/PLC Consultation

- Acreage Reporting

- NAP

- Livestock Forage Program

- Emergency/Disaster Programs