Raising a crop is challenging work. Early mornings and long evenings are required, and when the yield is plenty, there is nothing more rewarding. At SouthWest Ag we understand the support you need when you are faced with an unsuccessful or damaged crop. That’s why we want to help ensure your hard work is protected. We consult with you to select the right crop insurance policies that meet your risk management needs.

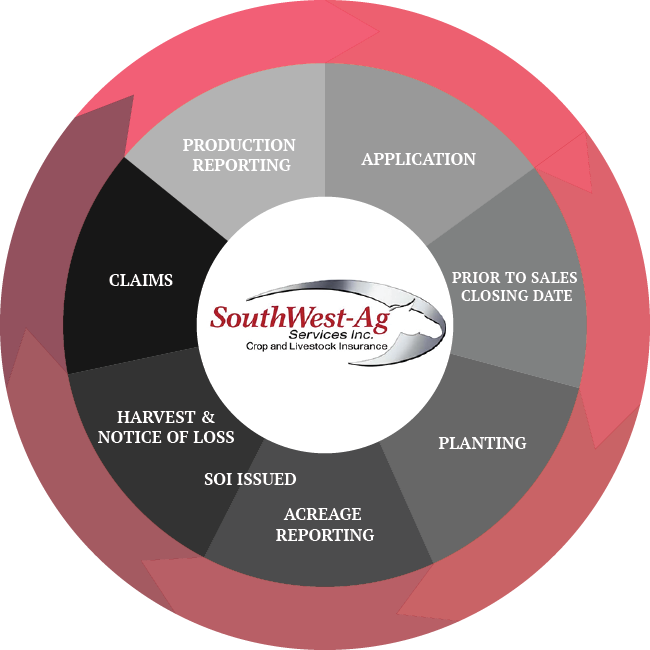

Step One:

Application

Your agent will meet with you to make the application process go as smoothly and efficiently as possible. A signed application is necessary to collect farming history, transfer data and APH information (including the most recent crop year) and begin setting up your operation in our systems to accurately advice you in coverage selection by sales closing date. We will determine what will best meet your needs whether it be Multi-Peril Crop Insurance, Crop Hail Insurance, Supplemental Coverage or Stacked Income Protection, to name just a few of the options we will discuss in the application process.

Step Two:

Prior to Sales Closing Date

Based on your farming structure and planting intentions, we will create customized quotes and share expertise to help you in making an informed decision on your crop insurance coverage. Your multi-peril crop insurance policy is a continuous policy but annually during sales closing you may change coverage levels or make other adjustments to your policy.

Step Three:

Planting

Plant your crops with peace of mind. No matter what comes- destructive weather, disease, drought, fire, flooding or insect damage- you are protected with Multi-Peril Crop Insurance. Upon completion of planting, you will submit certified acreage data and planting dates to FSA to attach to your policy.

Step Four:

Acreage Reporting

We encourage our farmers go to FSA to certify acres planted then request their 578s to be sent to us. With the implementation of the ACRSI program, you may certify with us and we will upload your information to FSA. We will key your acres planted into your policy based on your certification. Once completed, you will review and sign an acreage report to submit to the insurer. This report is used to create your schedule of insurance (SOI).

Step Five:

SOI Issued

Your Schedule of Insurance includes your coverage level selected, acres by farm/unit your acres and indemnity. The SOI also includes your billing information with your total coverage and premium due.

Step Six:

Harvest & Notice of Loss

Prior to harvest and during harvest, as you evaluate your crop you must notify us of any potential loss. Give us a call right away. We will submit a loss and the company will assign and arrange for a loss adjuster to complete a crop inspection. After harvesting your crops, you will send your data to your agent. We will take it from there.

Step Seven:

Claims

We pride ourselves on placing your business with companies who provide immediate processing of your claims. We represent the farmer and understand a sense of urgency in getting your claims evaluated, processed and paid in a timely manner.

Step Eight:

Production Reporting

Prior to the yearly production reporting deadline, your agent will create your production report which you will sign before submitting. We will advise you on good record keeping to help with post-harvest production reporting. It is imperative that your record keeping aligns with farming structure and insurance coverage for ease of production reporting.